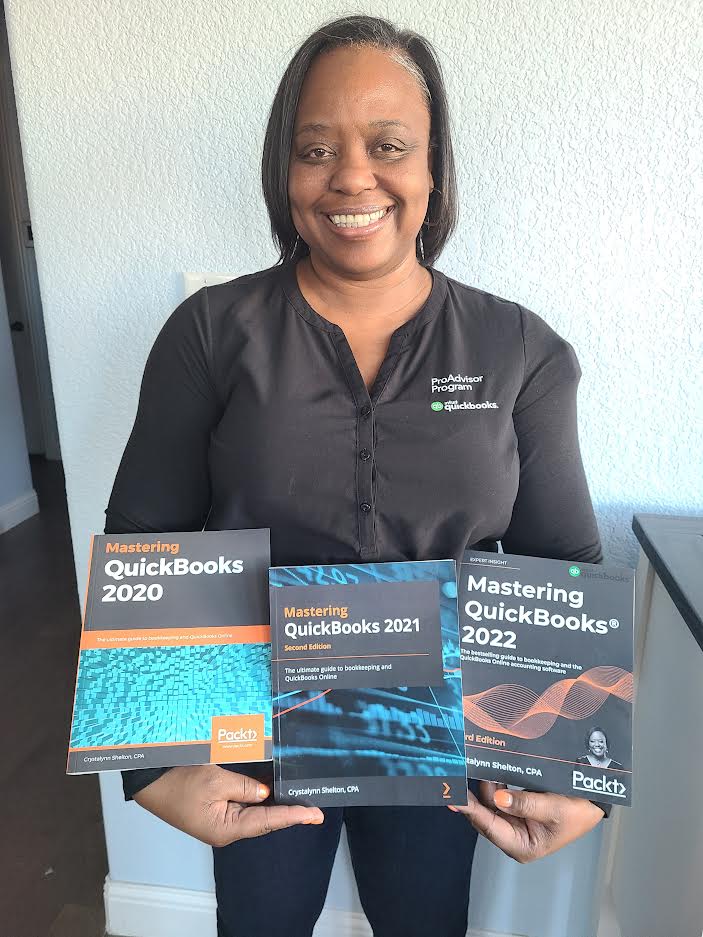

By Crystalynn Shelton

Hello Seven Client | Licensed CPA | QuickBooks Top 100 ProAdvisor

As a business owner, you’re focused on bringing revenue in the door. But once you’ve earned that money, you need to keep meticulous records too. If you’re sloppy with your invoices, not watching your expenses closely, or stuffing receipts into a shoebox, it comes back to bite you later. Crystalynn, a Hello Seven client, shares four reasons why you need to get a legit accounting system ASAP—and the first step to take if you feel overwhelmed.

It’s never too early to get prepared for tax season! As a matter of fact, the sooner you prepare, the easier tax season will be. If you don’t have a solid system of keeping track of your business finances, it’s time to get one. Accounting software like QuickBooks can make managing your finances a breeze! Instead of using Excel spreadsheets, shoeboxes, and pen and paper, why not use one system to track everything?

Why switch to an accounting software program? There are four main reasons. Making the switch means you can:

- Connect your bank account to the software

- Scan receipts and get rid of the paper

- Access key financial reports

- Easily give other people access to your data (such as a virtual assistant, business partner, or accountant)

Connect your bank account to the software

Accounting software like QuickBooks allows you to connect your bank and credit card accounts so that you don’t have to manually enter your expenses. This saves you time and minimizes the number of mistakes that occur with manual data entry.

Scan receipts and get rid of the paper

One of the main issues many businesses have is keeping up with receipts. This usually leads to missed deductions, especially if you paid in cash. With QuickBooks, you can easily take a snapshot of the receipt using the QuickBooks app and the information (along with a copy of the receipt) will be uploaded to the software. No more looking for receipts during tax time or trying to stick with an envelope system or the old shoebox method.

Access key financial reports

Have you ever tried to apply for a grant, a business loan or line of credit? What is the first thing that they ask you to submit? Yep, financial statements. Typically, this would be a profit and loss report (also known as income statement) and a balance sheet report. By keeping track of your finances in QuickBooks, you can generate financial reports in minutes! You can even email the reports directly from the software to the financial institution or print them out.

Easily give other people access to your data

Ready to share your data with your tax preparer? No need to drive over to their office. With accounting software like QuickBooks, you can give your CPA or tax professional access to your data by sending them an email invite directly from the software. They will be able to create a secure password and log in immediately. You can even limit their access to simply running reports so that they cannot make any changes to your data without your knowledge.

I’ve shared just four of the many benefits you gain from investing the time and money into getting your business up and running on accounting software. If you’re ready to get started with QuickBooks, head over to my website. Book a session with me so that we can discuss your individual needs.

You can also purchase QuickBooks using my discount code or get my self-paced QuickBooks course and learn in your free time. On a budget? Read my book, Mastering QuickBooks 2023. It is the 4th edition of my Amazon bestselling franchise “Mastering QuickBooks”, the go-to guide for business owners that need to get up to speed quickly on how to do their bookkeeping in QuickBooks.

As a small business owner myself, I know that your to-do list can feel a million miles long. You need to market your services, serve your clients, get paid, manage your team (if you have one), and handle countless other tasks, too. It’s easy to push accounting until “someday later” because you feel too tired or time-crunched to focus on it today. But the longer you push it off, the messier your situation becomes.

Carve out a few hours to get started with QuickBooks this week. Hire a professional if you need help. Get yourself organized! By doing this, you’ll keep thousands of dollars in your pocket because you’ll get every business tax deduction that you’re rightfully owed (and avoid costly penalties for making mistakes, too). The best part: you’ll feel tremendous peace of mind.

Once you get this handled, the only thing you’ll regret…is not doing it sooner.

-Crystalynn Shelton